Ashland details strong progress on value creation plan in letter to shareholders

Press Release

Ashland details strong progress on value creation plan in letter to shareholders

Announces filing of definitive proxy materials

Announces addition of Craig A. Rogerson to slate of nominees

Strongly recommends shareholders vote Ashland’s BLUE proxy card

|

|||||||||||||||

COVINGTON, Kentucky,

Ashland also announced that the board has unanimously determined to add Craig Rogerson to its slate of nominees for election at the 2019 Annual Meeting. Mr. Rogerson has served as chairman, president and chief executive officer of

“We are pleased to add Craig as an independent director to the board’s slate of nominees for the 2019 Annual Meeting," said Bill Wulfsohn, Ashland chairman and chief executive officer. “Craig brings to Ashland significant leadership and chemical industry experience, having served as CEO and a director at a number of public companies, including currently serving as CEO and chairman of Hexion. Craig’s addition follows engagement with several major Ashland shareholders to find a candidate that brings a unique skillset to the board as we continue to execute on our strategy, and his nomination is consistent with Ashland’s history of taking shareholder feedback seriously.”

Ashland strongly recommends that you vote to support the Ashland directors by voting the BLUE proxy card today FOR all 11 of Ashland’s qualified and experienced director nominees: Brendan M. Cummins, William G. Dempsey, Jay V. Ihlenfeld, Susan L. Main, Jerome A. Peribere, Craig A. Rogerson, Mark C. Rohr, Janice J. Teal, Michael J. Ward, Kathleen Wilson-Thompson and William A. Wulfsohn.

In conjunction with the definitive proxy filing, which took place on

Ashland’s definitive proxy materials and letter to shareholders regarding the board’s recommendation for the 2019 Annual Meeting can be found at www.AshlandValue.com.

The full text of the letter follows:

Dear Fellow Shareholder:

Thank you for your investment in our company. Ashland is making great progress as we transform into a leaner, more cost-competitive and growth-oriented specialty chemicals company. Our decisive actions are improving our competitive position and creating significant value for our shareholders.

Following completion of our Valvoline separation in

Despite this progress, a shareholder,

The Ashland board is a powerful advocate for investors and has a proven track record of delivering superior value. Therefore, we strongly recommend that you elect the Ashland directors by voting the BLUE proxy card today FOR ALL 11 of Ashland’s qualified and experienced director nominees: Brendan M. Cummins, William G. Dempsey, Jay V. Ihlenfeld, Susan L. Main, Jerome A. Peribere, Craig A. Rogerson, Mark C. Rohr, Janice J. Teal, Michael J. Ward, Kathleen Wilson-Thompson and William A. Wulfsohn.

FISCAL 2018: A YEAR OF PROGRESS DEMONSTRATING ASHLAND’S ABILITY TO DELIVER ON ITS COMMITMENTS TO INVESTORS

Fiscal 2018 was a year of great progress on Ashland’s value creation plan. We are not only delivering – but far exceeding – the financial commitments we outlined at our Investor Day in

Other highlights of our fiscal 2018 results include:

- Net income was

$114 million compared to$28 million in fiscal 2017; - Adjusted EBITDA2 increased by 20%, to

$683 million , compared to$570 million in 2017; and - Sales rose 15%, to

$3.74 billion , with double-digit sales growth in all three reportable segments (Specialty Ingredients, Composites, and Intermediates and Solvents).

As part of our EBITDA margin acceleration program, Ashland expects to report that it has achieved its target of

Importantly, the market recognized our progress to deliver enhanced shareholder value—during fiscal 2018 our stock price increased 28%.

We expect continued progress in fiscal 2019 and beyond as we realize the benefits from the EBITDA margin acceleration program and become a pure-play specialty chemicals company.

ASHLAND’S STRATEGY IS DELIVERING SUPERIOR RETURNS

The results of our efforts are reflected in Ashland’s shareholder returns. Our returns have outpaced the S&P Mid-Cap 400 and our proxy peers3 in recent years.4

Ashland Total Shareholder Return (“TSR”) vs S&P Mid-Cap 400

- Since completion of Valvoline separation on

May 12, 2017 , TSR is 21% compared to (2)% - 1-year TSR is 0% compared to (12)%

- 3-year TSR is 44% compared to 22%

- 5-year TSR is 59% compared to 33%

Ashland TSR vs proxy peers

- Since completion of Valvoline separation on

May 12, 2017 , TSR is 21% compared to proxy peer mean of (7)%. - 1-year TSR is 0% compared to proxy peer mean of (22)%

- 3-year TSR is 44% compared to proxy peer mean of 23%

- 5-year TSR is 59% compared to proxy peer mean of 17%

ASHLAND IS PROACTIVELY OPTIMIZING ITS PORTFOLIO TO DRIVE SHAREHOLDER VALUE

The board and management team have been positioning Ashland for profitable growth as a pure-play specialty chemicals company by divesting non-core businesses in order to create a more streamlined portfolio and by acquiring businesses that align with this strategy.

Since 2006, Ashland has divested (or announced definitive agreements to divest) more than

Ashland has also acquired businesses with attractive margins and growth opportunities, including Pharmachem, International Specialty Products (ISP), Hercules and Air Products Adhesives. Together, these acquisitions provide Ashland access to higher-margin and higher-growth end markets while strengthening the company’s product line and growing sales.

ASHLAND’S BOARD HAS THE SKILLS AND EXPERTISE NEEDED TO DRIVE CONTINUED GROWTH

Your board’s director nominees are composed of 11 highly qualified individuals, 10 of whom are independent, and all of whom bring experience in areas that are relevant and important to the company's business and continued success.

Valuable Experience in Areas Critical to Ashland’s Business Chart

The Ashland board is actively engaged in overseeing the company’s transformation and will continue to work closely with management to drive value for shareholders.

ASHLAND’S BOARD IS COMMITTED TO REGULAR, ONGOING REFRESHMENT

The Ashland board regularly takes steps to refresh and strengthen its composition. On

Illustrating the company’s history of regular, ongoing refreshment, the company noted that following the Annual Meeting, if elected:

- Six directors of 11 will have joined the board within the past three years

- Five directors of 11 will have joined the board since the beginning of 2017

Ashland’s average board tenure of six years is below the average tenure of the S&P 500 ofeight years and the S&P Midcap 400 tenure of nine years.9

ASHLAND HAS A TRACK RECORD OF RESPONSIVENESS TO SHAREHOLDERS

Ashland has regular and extensive communications with its shareholders, including with respect to board composition and governance matters. We appreciate the perspectives we receive from our shareholders during these conversations, including in recent conversations with several major shareholders regarding the addition of Mr. Rogerson to the board’s slate of nominees. We thoroughly evaluate and seriously consider implementing any suggestions from our shareholders that we believe will drive enhanced value for our company and our shareholders.

In addition to Mr. Rogerson, just last year Ashland nominated Jerome Peribere, who was recommended by Cruiser, to the board, and we are nominating Mr. Peribere for re-election this year, illustrating Ashland’s track record of taking our shareholders’ views seriously. Mr. Rogerson is now the third director recommended by shareholders that Ashland has nominated over the past five years.

CRUISER’S NOMINEES DO NOT HAVE ADDITIVE SKILLS OR EXPERIENCE

Ashland is always receptive to input from shareholders that may enhance shareholder value, including with respect to Cruiser’s recommendation of Mr. Peribere and his subsequent appointment to our board last year.

Contrary to Cruiser’s highly misleading claim, the Ashland board oversaw a robust process of review and evaluation with respect to Cruiser’s four nominees. At the board’s direction, each of Cruiser’s nominees was individually interviewed by Russell Reynolds, a leading search firm that has been advising Ashland in its ongoing board refreshment process. Following that review, Russell Reynolds conducted further research on and evaluation of each candidate and provided feedback and recommendations, which were discussed in detail with Ashland’s Governance and Nominating Committee and the full board.

After a thorough review of Cruiser’s four nominees, it was determined with the unanimous support of the board that the nominees were not additive to the skills and expertise of the existing board members. Importantly, the process followed with respect to the Cruiser nominees is Ashland board’s standard practice for reviewing potential candidates and is the same process that led to last year’s appointment to the board of Cruiser’s recommendation, Mr. Peribere. It is also important to note that one of Cruiser’s nominees is 83 years old, more than a decade older than the board’s mandatory retirement age.

While the Ashland board would prefer to forego the cost and resource demands of a proxy contest, it will not approve nominees who are not additive to the board simply to avoid one.

CRUISER HAS OFFERED NO NEW ACTIONABLE IDEAS

Your board and management team have maintained an open dialogue and held numerous discussions with Cruiser since they made their investment in Ashland. In fact, Ashland’s Chairman and Chief Executive Officer, Mr. Wulfsohn, and Governance and Nominating Committee Chair, Mr. Cummins, spoke with two of Cruiser’s nominees (Dr. Bill Joyce and Allen Spizzo) on

ASHLAND HAS A STRONG BOARD AND MANAGEMENT TEAM EXECUTING ITS TRANSFORMATION AND DELIVERING RESULTS FOR SHAREHOLDERS

Now is the time to focus on the continued execution of our successful plan and avoid disrupting the progress Ashland is making.Ashland has a strong team and strategy in place to achieve its objectives and is committed to regularly taking steps to refresh and strengthen its board membership to ensure that it has the right mix of experience and capabilities. Your board of directors unanimously recommends that you vote FOR the election of ALL of your board of directors’ nominees using the enclosed BLUE proxy card today.

We appreciate your continued confidence in Ashland.

Sincerely,

The Ashland Board of Directors

YOUR VOTE IS EXTREMELY IMPORTANT NO MATTER HOW MANY SHARES YOU OWN.

If you have any questions or require any assistance with voting your shares, please contact Ashland’s proxy solicitor:

Stockholders may call toll-free: 1 (877) 456-3402

Banks and Brokers may call collect: 1 (212) 750-5833

Remember, your board of directors does not endorse any of the Cruiser nominees and strongly urges you not to sign or return any White proxy card sent to you by Cruiser. If you have previously voted using a White proxy card sent to you by Cruiser, you can revoke that proxy by using the enclosed BLUE proxy card to vote by Internet, by telephone or by signing,

About Craig A. Rogerson

Craig A. Rogerson is the current Chairman, President and Chief Executive Officer of

About Ashland

C-ASH

FORWARD-LOOKING STATEMENTS

This communication contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended. Ashland has identified some of these forward-looking statements with words such as “anticipates,” “believes,” “expects,” “estimates,” “is likely,” “predicts,” “projects,” “forecasts,” “objectives,” “may,” “will,” “should,” “plans” and “intends” and the negative of these words or other comparable terminology. Ashland may from time to time make forward-looking statements in its annual reports, quarterly reports and other filings with the SEC, news releases and other written and oral communications. These forward-looking statements are based on Ashland’s expectations and assumptions, as of the date such statements are made, regarding Ashland’s future operating performance and financial condition, as well as the economy and other future events or circumstances. These statements include, but may not be limited to, the statements under “FISCAL 2018: A YEAR OF PROGRESS ILLUSTRATING ASHLAND’S ABILITY TO DELIVER ON ITS COMMITMENTS TO INVESTORS”, Ashland’s assessment on its progress towards becoming a premier specialty chemicals company and its expectations regarding its ability to drive sales and earnings growth, realize further cost reductions and complete the anticipated divestiture of its Composites business and Marl BDO facility.

Ashland’s expectations and assumptions include, without limitation, internal forecasts and analyses of current and future market conditions and trends, management plans and strategies, operating efficiencies and economic conditions (such as prices, supply and demand, cost of raw materials, and the ability to recover raw-material cost increases through price increases), and risks and uncertainties associated with the following: the program to eliminate certain existing corporate and Specialty Ingredients expenses (including the possibility that such cost eliminations may not occur or may take longer to implement than anticipated), the expected divestiture of its Composites segment and the Marl BDO facility, and related merchant I&S products (including, in each case, the possibility that a transaction may not occur or that, if a transaction does occur, Ashland may not realize the anticipated benefits from such transaction), the impact of acquisitions and/or divestitures Ashland has made or may make, including the acquisition of Pharmachem (including the possibility that Ashland may not realize the anticipated benefits from such transactions); Ashland’s substantial indebtedness (including the possibility that such indebtedness and related restrictive covenants may adversely affect Ashland’s future cash flows, results of operations, financial condition and its ability to repay debt); Ashland’s ability to generate sufficient cash to finance its stock repurchase plans; severe weather, natural disasters, cyber events and legal proceedings and claims (including product recalls, environmental and asbestos matters); and without limitation, risks and uncertainties affecting Ashland that are described in Ashland’s most recent Form 10-K (including Item 1A Risk Factors) filed with the SEC, which is available on Ashland’s website at http://investor.ashland.com or on the SEC’s website at http://www.sec.gov. Various risks and uncertainties may cause actual results to differ materially from those stated, projected or implied by any forward-looking statements. Ashland believes its expectations and assumptions are reasonable, but there can be no assurance that the expectations reflected herein will be achieved. Unless legally required, Ashland undertakes no obligation to update any forward-looking statements made in this communication whether as a result of new information, future events or otherwise.

IMPORTANT INFORMATION

On

CERTAIN INFORMATION REGARDING PARTICIPANTS

Ashland, its directors, director nominees and certain of its officers, including William A. Wulfsohn, Brendan Cummins, William G. Dempsey, Jay V. Ihlenfeld, Susan L. Main, Jerome A. Peribere, Barry W. Perry, Craig A. Rogerson, Mark C. Rohr, Janice J. Teal, Michael J. Ward, Kathleen Wilson-Thompson, J. Kevin Willis, Peter J. Ganz and Seth A. Mrozek, will be participants in the solicitation of proxies from stockholders in respect of the 2019 Annual Meeting of Stockholders. Information regarding the ownership of the Company’s directors and executive officers in the company by security holdings or otherwise is included in Ashland’s proxy statement for the 2019 Annual Meeting of Stockholders, which was filed with the SEC on

APPENDIX A

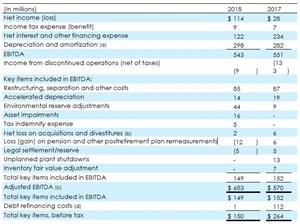

EBITDA and Adjusted EBITDA Reconciliation

EBITDA and Adjusted EBITDA Reconciliation Chart

(a) Excludes

(b) Excludes expense of

(c) Includes $9 million and $8 million during 2018 and 2017, respectively, of net periodic pension and other postretirement costs (income) recognized ratably through the fiscal year. These costs (income) are comprised of service cost, interest cost, expected return on plan assets, and amortization of prior service credit and are disclosed in further detail in Note N of the Notes to Consolidated Financial Statements in Ashland’s Form 10-K filed with the SEC on November 19, 2018.

(d) Debt refinancing costs during 2018 primarily included a $1 million charge for new debt issuance costs incurred with the re-pricing of the term loan B facility. Debt refinancing costs during 2017 included $92 million of accelerated accretion from the tender offer of the 2029 notes, a $16 million charge for early redemption premium payments and bondholder consent fees for senior notes due 2018 and 2022, a $9 million charge for debt issuance costs resulting from financing activity for the 2017 Credit Agreement and a net gain of $5 million related to the repayment of notes due 2029. All debt refinancing costs were recorded within the net interest and other financing expense caption on the Statements of Consolidated Comprehensive Income (Loss). See Note J of the Notes to Consolidated Financial Statements in Ashland’s Form 10-K filed with the SEC on November 19, 2018 for more information.

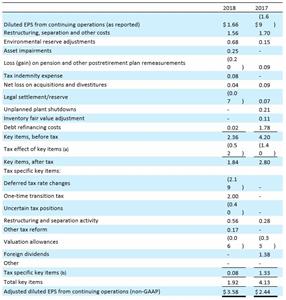

Diluted EPS and Adjusted Diluted EPS

Diluted EPS and Adjusted Diluted EPS Chart

| (a) | Represents the diluted EPS impact from the tax effect of the key items that are previously identified above. |

| (b) | Represents the diluted EPS impact from tax specific financial transactions, tax law changes or other matters that fall within the definition of tax specific key items. For additional explanation of these tax specific key items, see the income tax expense (benefit) discussion within the caption review section in Ashland’s Form 10-K filed on November 19, 2018. |

FOR FURTHER INFORMATION:

Investor Relations: Media Relations:

Seth A. Mrozek Joele Frank, Wilkinson Brimmer Katcher

+1 (859) 815-3527 Steve Frankel / Jill Kary

samrozek@ashland.com +1 (212) 335-4449

1 See Appendix A for a reconciliation of Adjusted Diluted EPS to Diluted EPS.

2 See Appendix A for a reconciliation of Adjusted EBITDA to Net Income.

3 Proxy peers include Albemarle Corporation (ALB), Axalta Coating Systems (AXTA), Cabot Corporation (CBT), Celanese Corporation (CE), Eastman Chemical Company (EMN), FMC Corporation (FMC), H.B. Fuller Company (FUL), Huntsman Corporation (HUN), International Flavors & Fragrances (IFF), NewMarket Corporation (NEU), Olin Corporation (OLN), Platform Specialty Products Corporation (PAH), Polyone Corporation (POL), RPM International Inc. (RPM), W. R. Grace and Company (GRA), and Westlake Chemical Corporation (WLK). A. Schulman not included due to acquisition by LyondellBasell completed on August 21, 2018.

4 All TSR figures are as of December 27, 2018, the last possible date before going to print.

5 Divestitures include Valvoline enterprise value of $5.3 billion post-final separation as of May 15, 2017, Water Technologies sale price of $1.8 billion, APAC sale price of $1.3 billion, Ashland Distribution sale price of $979 million, Drew Marine sale price of $120 million, Elastomers sale, and Composites and BDO announced sale price of $1.1 billion.

6 Biographical information for each director nominee may be found in the section “Proposal One—Election of Directors” in Ashland’s proxy statement.

7 Mr. Cummins serves on the board of Nanco Group Plc, headquartered in the United Kingdom.

8 Ms. Wilson-Thompson also brings valuable experience in managing significant corporate change and related personnel issues.

9 EY Center for Board Members – Corporate Governance by the Numbers.

Attachments

- Valuable Experience in Areas Critical to Ashland’s Business Chart

- EBITDA and Adjusted EBITDA Reconciliation Chart

- Diluted EPS and Adjusted Diluted EPS Chart

Source: Ashland LLC